Home// Articles// Fundraising// How To: Raise a Seed Full Guide

How To: Raise a Seed Full Guide

Russ Wilcox

CEO at Trellis Air

Russ Wilcox

CEO at Trellis Air

Introduction

Do you have a high-potential idea for starting a major new company? Would having additional capital make the difference between winning big and going home?

If the answer to both is yes, then raising a seed investment from professional investors could make sense.

It’s no easy task. Out of the 600,000 companies started in the United States every year, only 1% raise seed capital from angels, and only 0.5% raise seed capital from institutional VCs.

What do we mean by Seed? Here is our breakdown of rounds and roles:

In short, if you already know what product you want to build, you are raising Seed.

If you are still just exploring a hunch and confirming whether there is interest and feasibility and deciding on your business model, you are still in scout mode. You should be bootstrapping rather than raising a Seed round. Take every step you can to get the basic questions answered before you try to raise capital. You should be able to come quite a long way with your own pocket money.

If you do need a bit of cash, we generally see that the first $10-50K for any new venture will come from your own savings, or from family and friends who know you well and will take a blind plunge.

What if you need to raise $50-250K+ to figure out if you have something or not?

First, consider participating in business plan contests, applying for SBIR grants, and joining incubators. Otherwise, try to follow a lot of the advice in this Seed guide, but target local angels and scouts for a Pre-Seed financing.

Seed-stage VC firms come into play when you are raising $500K to $5M in your first outside round. To justify that size of check, most VCs do want to dig into the idea, look at prototypes, and see a detailed business plan.

Finally, the situation is a bit different in two special cases. Serial founders can often jump to VC funding just on the basis of a general direction. And technical founders who have a licensable science or technology will find that some VC firms (such as PillarVC) are prepared to work actively with them to spin out a company. Pillar repeatedly has helped lab-stage inventors with high potential technologies find a business partner and close the first $3-5 million seed round, often starting even before company incorporation.

If you do think you are ready to raise a Seed round, this guide offers a step-by-step roadmap.

1. Confirm Your Idea Is Backable

As you and your cofounders discuss starting a company together, you will likely consider multiple ideas and business plans. How do you know whether a specific idea is worth pursuing?

Here are four key questions to ask:

1. Who will buy it and why?

2. Do you make money per unit (customer)?

3. How much can you sell?

4. Who will eat your lunch? (Can you protect your profits?)

While the questions are simple, they take a lot of work to answer. The good news is that after you develop and document the answers, you will have created an important body of work that will help you recruit, sell, and raise capital.

1) Who will buy it and why?

A surprising number of founders have no clear idea of who will buy their product. They look at a large market size number, and once they convince themselves that the market is large, they assume sales will come later, somehow. This is a sign of inexperience.

A better approach is to engage in market research, surveys, focus groups, and interviews with live customers. Yes, it takes elbow grease! Active listening leads to insights on product design. The more specifically you identify the customer, the more insightful and successful your product will be. The more tangibly you can simulate your future product using prototypes, wireframes, and samples for a near-accurate experience, the better the customer feedback will be.

The cost to be an active listener is minimal. These days you can have a barebones or MVP app built for a few thousand dollars. You may find a marketing student to write a brochure for free, or a mechanical engineering student who will help you 3D print a physical sample for a few hundred dollars. Or you can make a diagram or draw buttons on PowerPoint, or simulate live buttons easily with Figma or Adobe XD. It costs nothing but time to find customers and interview them, and you can even record the meetings with voice or video to create an asset for future reference or show-and-tell with investors. Services like UserTesting.com allow you to receive customer feedback in hours, not days.

Engage in market research, surveys, focus groups, and interviews with live customers. Active listening leads to insights on product design.

As the product vision firms up, continue meeting customers with increasingly detailed pitches. Start to name a price – then ask the customer to buy it for real! Suddenly you hear a lot more about what it will actually take to deliver a product people want to buy. Don’t worry about whether you can ship yet – you don’t need an actual product to take a real order. Show a brochure or demo and explain the price point and ask for the order.

Most

least

See what level of commitment customers are ready to make, following this spectrum from most to least

- They will pay you big money up front to help you develop the product, just so it exists and they can buy it

- Place a binding order and pay in full up front (like Kickstarter)

- Place a binding order and pay a 10-20% deposit

- Sign a non-binding purchase order or detailed letter of intent (LOI) that says “if you can build a product with X specifications at Y price, then we expect to purchase Z quantity”

- Pay you significant money just for one prototype or sample, or to become a test user

- Won’t sign anything, but willing to endorse idea to a prospective investor or journalist

- Won’t sign anything, but willing to introduce you to others

Be wary of polite answers when you start sharing your product concept. The Mom Test is a quick read and nicely explains how to run customer discovery interviews without “leading the witness”.

There is also a great, 8-minute video about customer interviews for product feedback by Jake Knapp (ex-Google Ventures) here.

Be wary of “Would you buy this?” quantitative surveys which can often overstate demand. An old rule of thumb is that if you ask customers on a survey if they will buy, you should square the result to predict actual orders. For example, if 20% of surveyed customers say they will buy, only 4% of actual customers would buy.

2) Do You Make Money per Unit (Customer)?

“Unit economics” is the topic of how money flows when you grow by one extra customer (in a subscription or loyalty purchase business) or sell one extra order (in a widget business).

For digital businesses with very low variable cost, the discussion centers on two metrics: the cost of acquiring customers (CAC) and the lifetime value of customers (LTV).

You should start by focusing on the LTV side. Life-time value means the total profit you will earn from a customer over time (and discounted for churn rate and interest in the out years) and should not be confused with lifetime revenue. So you will need to pick a price and also estimate your variable margins.

How to position the price? There are five value propositions in classic marketing theory:

- Get less for less – a trimmed down version of an existing product; the Kia

- Same for less – well-known product at a discount, like Nordstrom Rack

- Get more for less – a true innovation, like a new PC with twice the power at half price

- More for the same – for the same price, you get extra, like Little Caesar’s double pizzas

- More for more – you pay extra and you get extra, like staying at the Ritz

Imagine your business a few years from now, right at the moment you want the company to hit breakeven. For example, suppose you want to break even at $20 million in revenue.

- How many customers would that represent and at what price point?

- What is your goal for variable profit per sale?

- How many shipments or traffic or transactions will it take?

- What are the operating requirements to support that much business?

- How many people would you need handle that much volume at each operating step?

- Draw your organizational chart at the breakeven

- Estimate your fixed expense to be in business with that size staff

- Check if your variable profits will cover the fixed expense?

- If not, go back and see what assumptions you would have to change to hit breakeven, and see if you can find a way to hit those assumptions

To sanity-check your assumptions, calculate your model’s revenue per employee. Generally a commodity business has revenue of $125K per employee; a breakeven tech business $250K; and any business at $500K or above is super attractive. How does your model compare?

By developing the projections above, you will have a good sense of where you expect to arrive on product costs within the first few years of operation. These are the “target costs” you should use in your pitch deck. If your actual costs at the beginning will be higher then you should note that, and explain your plan for cost reduction.

3) How Much Can You Sell and How?

Accurately assessing the upside is key to deciding whether this idea is worth your own time and if so, choosing how to finance the business.

Jit Saxena, a well-known serial founder and angel in Boston says “The biggest mistake founders make is not picking a market big enough to justify the massive effort required to build a business.”

The revenue potential for a company is called the TAM or Total Available Market – the amount of revenue your company could earn if every customer who wanted to buy the product did buy from you. Another way to think about this is the sales of your company and all its direct competitors added together.

To calculate this means carefully dissecting how the market works and knowing which customers could buy your product and which never could. A common mistake founders make is to trumpet a market size number they can find on the Internet that is big and impressive, without thinking about it critically.

For example, a start-up writing hotel management software might claim “the global tourism market is over $8 trillion annually!” VCs cringe because that is a gross generalization. It appears to be a cynical attempt to inflate the company’s prospects, or perhaps lazy thinking. (It is cliché for a founder to then say in the next slide “if we only take 1% of that giant market we will be rich”. Fast way to blow your credibility.)

A big market size is an illusion because each customer is different in some way, which means every market is composed of smaller segments. Your company will serve some segments well, some poorly, and some not at all. You need to do your homework and figure out the realistic prospects both for your first product and for your long-term goals.

The smaller the market segment, the more closely your product can fit the unique customer needs of that segment and the better your chances of success. Of course, a smaller company will be worth less. So the way you define your market is really an indication of your ambition for the business.

My advice here is to keep narrowing markets down into smaller segments until you reach a target market that is only 5-10 times bigger than your long-term revenue goal for the company. Why? Think about it this way: for your company to be successful, you should aim to become one of the leaders in your category. In many industries, that means a market share of 10-20% or more.

If your goal is to build a high-potential venture-backed company with a chance at unicorn status, then $100-250 million in sales is big enough to achieve that valuation, and so you want to keep narrowing your company’s focus until you are down to a target market of $1-3 billion. If you go after a larger market, you are in danger of diluting your company’s attention over too many customer types and failing to please any group well enough to win adoption.

If the market is smaller, only you can judge whether there is room to build a company big enough to satisfy your ambition. If you do want to proceed, that is terrific. You just need to find a way to finance it without venture capital however, because venture capitalists only want to back unicorns.

A red flag we often see in venture capital is that when a start-up’s market size is small (but the founder wants to raise venture capital anyway) the founder tries to convince investors that the company can get to unicorn scale by entering “more markets later”. The problem with this is that every time you enter an additional market, you take on new customer requirements, a new branding effort, a new sales effort, a new regulatory regime, new channel partners, new PR strategy, and so forth. The capital requirements grow higher, but the odds of winning all of those market battles simultaneously fall lower. It’s a poor bet for both founder and investor.

In sum, do the work to accurately assess revenue potential, and if the size looks right for you personally, then hunt for matching investors who like your scale of company, rather than changing your goals to please investors.

4) Can You Protect Your Profits Over Time?

This is the most strategic and hardest of the four questions.

Imagine you launch a great product and start to grow quickly. What happens next? Life gets TOUGHER, because you will attract hostile attention from the incumbents who are losing business, and at the same time, a host of fast followers emerge to steal a piece of your success.

When asked about these dynamics, most founders grow impatient or a bit uneasy. It seems hard enough right now just to build a good product; they want to worry about the rest later. However, they can end up wasting years of their lives, if they don’t anticipate how to deal with competitors well in advance.

Incumbents have grown adept at squashing competitors. They have an automatic allergic response to start-ups. Come up with a new flavor of soda and start to gain sales? You can bet Coke or Pepsi will introduce a similar flavor, and kill your business. Or they will simply pay higher slotting fees, and your product will be on the bottom shelf. Think of how FaceBook added stories to Instagram as a way to defuse Snap. Create a new interface for tracking tweets? Twitter comes along and shuts you down because they want to control the use experience. Start selling a tool for managing salespeople that takes off? Suddenly Salesforce, Oracle, Microsoft, and IBM start offering a similar tool to the accounts they already own and you have nowhere to sell.

If you do have a good answer for fending off the incumbent response, next think about copycats. Let’s assume your business grows exactly as intended, but then everyone sees what you are selling and how much profit you are making. What stops someone else from eating your lunch? Peter Thiel calls this the need for a moat.

There are graveyards full of startup ideas that die at that question, so it is worth exploring a variety of ways that start-ups can use to protect their hard-won profits.

Types of Moats

The best answers are when there is something about the business that creates a first-mover moat. If the start-up can break out and capture the lead, then it can gain from speed or scale or experience in a way that snowballs and makes it a permanent leader. Here are some examples:

Network effects grow with time and are highly attractive because they grow exponentially fast. Here is a network effect: when Bell Labs has 2 phone subscribers on the first day, there is only 1 potential conversation. But with 10 phone subscribers, there are 9×10/2 = 45 potential conversations, and this grows exponentially (Metcalfe’s Law). When Facebook adds one person, that person not only receives benefit for themselves, they also create benefit (by adding content) for everybody else. The basis of a network effect is interoperability – anyone on the network can interact with everyone on the network.

Two-sided marketplaces have a network effect. If the most buyers for rare stamps are on eBay, then everyone selling a rare stamp will go to eBay, and this attracts even more buyers. The most drivers are on Uber and Lyft. The most apartments on AirBnB, the most travel reviews on TripAdvisor, the most sports gamers on DraftKings, the most furniture on Wayfair. Once a clear winner in each of these marketplaces emerges, they have an enormous edge over smaller sites.

Setting the standard is another type of first-mover moat. Once a leading standard emerges, such as Linux, then more support and more effort and services are offered for that standard and it becomes unbeatable. Because of the power of this effect, engineers try to build their products using standards that are open-source and controlled by a committee rather than one company. However, there is a chance that a market-leader in each “layer of the stack” (meaning each of the layers of hardware, network, operating system, development tools, analytics, and applications) will obtain such high share that everyone will adopt them, and then they can achieve a privately-owned standard. Intel and Microsoft did this in the PC era and earned many billions as a result.

The experience curve is the learning that occurs when an organization repeatedly makes the same product or provides the same service. This effect was identified and explored by Boston Consulting Group (BCG) in the 1960s. They were working with a semiconductor manufacturer and figured out that for every doubling in total units produced since inception, the manufacturer was able to find a variety of ways to reduce cost by 25% per doubling. Since then many industries have been shown to have experience curves of typically 10-20%. Once your company has the highest volume, it learns at the fastest rate, and so you always have the lowest cost.

Economies of scale occur when size drives a cost advantage over smaller rivals. This sounds like a manufacturing effect but it is also key in software – once you write the software, there is no cost to making copies. So whichever software company is bigger will earn a higher profit, which they can then reinvest to grow even bigger.

Economies of scope refer to cost reductions you can achieve by combining different products. For example, if you are selling someone a movie ticket, you get to sell them drinks and popcorn. The biggest exploiter of this effect that I know is Amazon – come there for anything and they will cross-sell you every accessory, plus nearly anything else you can think of, all in one order.

If a business cannot access these powerful, self-reinforcing first-mover moats, then there are still some other strategies available to create a less powerful but still respectable moat.

One example is territorial dominance. Once WalMart expanded into smaller cities and soaked up each local pool of demand, there was no room for a rival to also enter profitably. Our portfolio company Soofa places digital signs on city streets; once there is a Soofa sign on a certain corner, it is doubtful that the city will approve a similar sign from a competitor on the same corner. If a chain like Dunkin’ Donuts or Pizza Hut can deeply penetrate a city, they can spread costs of citywide radio, TV and newspaper ads across many storefronts for an unbeatable edge on ad costs. These businesses may not be monopolies on a national scale, but they are on a local level. If this is the dynamic then people call it a “land grab” market.

Captive channels can have similar benefits. Businesses that spend years patiently building up networks of distributors are creating a barrier to entry because competitors cannot easily sell through these channels without displacing the incumbent. Apple invested in stores so they could have captive relationships with customers. Netflix movies can be certain of distribution through Netflix. The Avon salesforce would be difficult for a competitor to poach.

Another example is mastering complexity. For example, few companies understand how to design software to handle airline reservations. Even if you wanted to enter the business and could see how the existing players operate, here’s just too much going on behind the scenes to easily imitate. In our world, E Ink had to understand chemistry AND optics AND coating AND device controllers. That technical complexity yielded substantial trade secrets but the complexity can be non-technical. Subway is known for having a franchise operating manual that is a masterpiece and helps ensure every store runs tightly. Construction companies who know how to manage massive projects are able to bid on major public works when their smaller competitors could not.

Another moat can come from patents. That’s good, but not as appealing as a network effect, because it costs money to enforce a patent, while scale economics enforce themselves. On the other hand, patents are moats that even individual inventors can use for protection.

Another medium-strength moat is regulation by the FDA. Although it can cost hundreds of millions or even several billion dollars to develop a new drug, once you are approved then the FDA will typically only approve one of your competitors if their product is the same or better than yours. You get to set the “standard of care.” Once products hit the market, there is no room for knock-offs until they go off-patent. Prescription drugs are heavily restricted – only doctors can prescribe, only pharmacies provide. And if a clone drug could somehow get onto the market, the infringement of your patent will be immediately obvious because chemical compositions of drugs are easily tested. The reason that VCs can bet so heavily on drug development is because there are strong barriers to entry.

Since these barriers are purely legal, they are not completely reliable. The government of India often forces drug makers to license their patents for cheap local production. Companies that find a new use for an old drug may receive a patent on the use, but they cannot easily stop doctors from prescribing the old drug off label for the new purpose.

Be careful of betting on regulatory edges that can be changed on a whim by politicians. One CEO in our Forum spent millions of dollars to develop software to help hospitals meet a new requirement created by Obamacare. By betting early, he expected to be the only software provider available to hospitals ready with a solution before the requirement took effect. However, when the deadline approached the hospitals just all complained to the government that they were unprepared. The government agreed to push back the deadline by several years, and his market evaporated.

Customer switching costs are another moat that can be strong. Once you buy a home alarm system, you may be required to use the manufacturer’s proprietary monitoring service until you are willing to rip it out and buy a different system. Training and habits can also become switching costs – after graphic artists devoted years of effort to learning Photoshop, they were not eager to switch to a new tool.

If there is no strong moat, I commonly hear these kinds of answers: “we have a built-in cost or sales or marketing advantage due to a relationship with (some large company like IBM or AARP)”, “we will build a consumer brand”, “we all personally come from this market and we uniquely understand what the customer wants so we will have the best design”, or “our culture will emphasize (innovation, cost, customer service)”. These are all examples of how normal businesses compete and pretty shallow as moats go. If you start this type of business, you must expect to live on thin margins and spend a lot of time hustling to beat competitors. You should probably try to think of a better idea.

Here is an example of where the moat discussion killed an idea. I spoke with a start-up team who was interested in helping restaurants take more mobile orders for carry-out. They could show restaurants loved the idea, they knew how to deliver the product at a profit, and they could list many small chains who might buy. So that was a green light on the first three questions, but we had a problem when it came to competition. They said none of the larger players selling restaurant software had yet added this feature except for one. That competitor was targeting restaurant chains of 15 or more units. So the founders said they would focus just on chains with 5-10 units and it would be a land grab situation.

The problem we then discussed was that if they started to succeed, would it attract attention? The existing competitor could easily target 5-10 unit chains. The other large players also could easily add mobile orders to their software if they saw the start-up gaining steam with this feature. Then mobile ordering would become a commodity feature. So, we did not invest.

If your profit barrier will be weak, what should you do? Face the facts and change your approach while you still can! If you waste your career building a company that cannot protect its profits, your investors will earn a disappointing return, but it is you who will never get back your time.

2: Forming a Company

When to Incorporate

Stay employed while you assess an idea and right up until the moment you either start building product or sign your founder agreement. The founder agreement requires you to assign your inventions and work product to the start-up, and since your current job likely requires that you assign those to your employer, you would have a conflict to hold both positions at the same time.

Some people do moonlight or try to keep working while building a product for an outside company. If so, you should talk openly with your boss and make sure it is OK; ask for a letter from the company agreeing that you can do so without your employer gaining any interest in the venture or the IP you create (outside the workplace) for the venture. In return you can give them plenty of notice of your departure and help hire and train your replacement.

If you are working, keep your job as long as you can. Every paycheck now helps reduce stress later.

Another nuance here is for foreign students who are in the USA on a study visa. You are not allowed to look for work under that program. Carefully consult with an immigration attorney before you open a bank account or take any step toward actually starting a company, and see what options are available for you.

The time to incorporate is after (1) you know you have a valid idea; (2) you have a clear plan and budget in view; (3) the people around the table have cash or savings to fund at least the walking around costs; and (4) the founders understand how they will divide the equity. If you are working with a licensed technology then you should also have (5) a verbal agreement that the licensing officer intends to work with you to negotiate a license or license option.

Incorporation can be done in a matter of a week or two, however, it will actually take a lot more elapsed time because the founders have to come to a meeting of the minds on all these issues first. In most cases it takes 3-6 months to form a company, so manage accordingly.

Splitting the Pie

The best time to divide equity is right at the beginning, when everyone is in a good mood and there is no significant value.

Edison famously said “Genius is 2% inspiration, 98% perspiration.” The same is true for companies. Most equity has to be reserved for the people who will risk their careers and life energy on the 98% of the work to build the business, not on the people who came up with the original inspiration. How do you balance that in a fair way?

Framework for Splitting Founder Equity

As the quote suggests, an idea by itself is worth very little. If a portion of the equity is set aside for the founders in return for creating the company, or perhaps for helping during the first few months only, it should be only a few percentage points. However it could go as high as 20% if the founders are bringing a substantial technology knowledge around an invention, for example in the case of a deeptech company emerging out of an academic lab, and at least half of that portion also should be vesting over the next four years, to account for the role the “creators” play as they help refine their original concept into a commercial reality.

What about compensating academic founders for a patent invention? Actually it is the university that owns the patent, and for that the university typically receives a small sliver of equity plus highly valuable royalties. Those royalties will be shared with the academic department and the inventors according to a university formula. So the company itself does not additionally compensate academic founders for patents.

Of the 0-20% allocated for the creators, this should be shared out according to their respective ability to contribute to the evolution and commercialization of the idea over time and it should be balanced by a vesting schedule and IP assignment agreement.

For example, as in the chart below, you might have a professor who will be a consultant for the company and two grad students who are willing to join the company, each holding 30% of the creator portion, with the last 10% shared amongst perhaps a few other advisors.

Creators (20%)

Management and Employees (80%)

Professor (6%)

CEO (26.67%)

Key Grad Student 1 (6%)

3-5 VPs(26.67%)

Key Grad Student 2 (6%)

6-10 Key People (18.66%)

Others (2%)

10-20 Junior People (8%)

Within the management and employee category, this is an area where there are classic rules of thumb: the CEO gets 1/3rd, the VPs share 1/3rd, and the rest of the employees share 1/3rd. These portions are allocated against the team that you expect to have in place at the time of Series A, so perhaps across 20 or 30 heads. Until those people are hired, their budgeted options would sit unused in an option pool.

Now here is a key point to using this framework: founders who join the company full time will participate in both columns. A grad student who helped create the invention may also join the company to become a VP, and then would receive 14% (7% as a creator and another 7% as a VP).

Within the levels in the table above, there will further be some sorting according to relative strength and also order of entry. The first person to join the company is taking a bigger risk and likely will get some extra stock to reward that. So if the ten key hires (for example, product managers, directors, seasoned technical developers) will receive 1.5% on average, then the first one might get 2%, the next three 1.5%, and the last one 1%.

With an option budget in hand, you will know how many options you can afford to give to early hires and be assured of having a fair allocation even two years down the road.

Options typically will vest over four years, with no vesting until one full year has elapsed, at which point 25% vest, and then the remainder vests evenly every month or quarter for the next three years. You want to have a corporate attorney create a stock option plan, a draft offer letter, and minutes after each board meeting to approve each option grant to keep all this in good order.

The Percents Change, So Focus on Proportions

As the company raises capital, there will be dilution. Suddenly all of the percents in the table above will look smaller!

By the time Series A closes, the CEO may only own 10%, and by the time of an IPO, only 3%. Every other value in the table scales proportionately. But bear in mind that 3% of a mature company will be far more valuable than 30% of a paper idea.

Therefore you should not concentrate on any particular percent ownership.

Focus on how the pie is divided initially among founders and employees. Should one founder get twice as much as the other? That ratio will remain fixed as the company raises capital, and so the relative proportions are the key to whether you have relative fairness across the team.

Founder Agreements and Vesting

Why do we require vesting even for the founders? This protects everyone. Fighting could lead one of the founders to depart. Even if the chemistry works, founders may leave unexpectedly. Sometimes founders have personal problems such as medical issues, depression, alcohol, family distraction, moving spouse, aging parent. Sometimes the business just evolves away from the expertise of a founder and they become unnecessary and agree to leave.

For all these reasons, you need to have legal documents in place right from the start.

The documents should ensure that founders vest the bulk of their stock over time, so that if a founder leaves, the company gets back enough shares to hire a replacement.

Developing a Workplan and Operating Budget

Now that you have solved your blind spots, understood your greatest risks and diligence enough to feel they are smart bets, selected an application and defined your product concept, it is finally time to write your workplan.

List the key milestones the company wants to deliver that can occur within 12 months. For now, focus on what it will take to develop a great product and sell it to just enough customers to prove they like it and you have a product-market fit.

Figure out what has to happen month by month over the next 6-12 months to achieve the goal. What people are needed? What other costs will you have? Make the milestones SMART (specific, measurable, achievable, resourced, timebound).

Now create a spreadsheet, with one column per month. Or download our budget template.

List each person and figure out their monthly cost. Don’t forget to add a 25% overhead charge on top of salary to cover payroll tax and fringe benefits.

Add rows for non-labor expenses like office rent and advertising.

Add it all up to find out how much cash you need per month. Create a “cumulative” row to show the total cash burn since inception as it climbs from month to month. The goal for your seed financing should be to raise enough cash for 12 months plus about 50% extra for safety.

The First 90 Days – A Checklist

Once the documents are done and everyone is aligned to move ahead, you will be eager to raise seed capital and you can start having some conversations. The ideal response at this early stage would be if an angel or seed VC says “Yes, assuming you can raise the full amount you need on fair and reasonable market terms, then I would be in for X dollars.” You will likely need several more months though to collect enough such checks to close a round.

In the meantime, your initial cash, meaning the first $10-30K or so, is most likely to come from your own pocket and that of your co-founders, friends and family. So pass the hat. If you can’t scrape together that much from people who know you, you will have a hard time convincing investors that you have the ability to raise millions in the future from people who don’t.

The First 90 Days

- Pick a name and reserve a URL, a Twitter handle, and a Facebook page.

- Retain a business lawyer and sign their engagement letter. Look for a law firm in your area that specializes in serving venture-backed companies, as they may be willing to do this and the next few steps at a reduced or deferred cost.

- Select an initial address. This can be your home, a co-working space, or your law firm.

- Ask your lawyer to incorporate you. The cost is usually under $1000. They may agree not to bill you until you raise seed capital.

- Open a bank account. Silicon Valley Bank, SquareOne, and others have special programs to win the business of venture-backed banks. So go to one of those and you can avoid fees. You will need your incorporation number.

- Direct lawyer to draft founder documents. These cover initial shares, vesting, IP assignment, voting, and Board seats. You may also set up a stock option plan at this time that will address restricted stock and handle unvested founder shares. Founders sign the founder documents and buy their founder shares; usually just $0.001 per share or a few $K. That goes in the bank.

- If you really think your personal shares could have an exit value that brings you over the lifetime exclusion cap for estate planning, then the founding of a company is a special moment when you may avoid estate taxes to some extent. You have to own vested shares. If you do, immediately upon buying your founder shares, you can move some shares into a family trust where your spouse and kids are beneficiaries. Since the shares are only worth $0.001 at time of transfer, you may be able to put a wad of stock into their names without using up your lifetime cap and thus you may avoid estate tax that would have been due if you kept the shares in your own name.

- Founders, friends and family chip in some cash. You deposit this in the bank. You can write a simple letter to each, that says the company owes them the money, either with or without interest. Later when it is time to finance the company you can roll them into a seed round or convertible debt round. Or, if they will be putting in serious money like $100K or more, ask the lawyer to draw up a convertible note.

- Keep all receipts of expenses you pay. If founders need reimbursement, make sure they get receipts.

- If you need a license, start working with the licensing officer. Ask for a 3-, 6- or 12-month option letter, which means you have the right to take a license later on known terms and conditions, but will not actually have to pay much cash up front or negotiate the complex contract until you get the company off the ground. If you came out of a university or job and you feel that you invented IP during the time you were there to which they have no rights, you can confirm that for yourself and your investors by asking the university license office to give you a waiver letter that agrees they have no rights.

- Begin executing your plan, developing materials, interviewing customers, and recruiting advisors.

- If you conceive or reduce to practice a patentable invention after incorporation, find a patent agent or attorney and file a provisional. For frontier technology companies, doing this comprehensively is one of the first priorities since days may matter for patents.

- Select a web host and put up a landing page and email auto-forwarding.

- You may wish to sign up for G-suite and set up email accounts.

- Choose a logo and if you desire, make cards. Update your social media.

- Go and raise the seed capital you need in your plan (see below).

- Once the seed is raised and deposited, you can open a payroll service like Gusto or ADP. Get everyone’s information and set them up for payroll.

- As they become needed, ask lawyers to also provide you with the following blank contracts: 1-way NDA, 2-way NDA, offer letter, employee documents (IP assignment, NDA, non-compete/solicit if appropriate), agreement to hire outside consultants (if needed), advisory board documents (if needed).

- After that, personally I use Excel to manage the cap table and finances until the company has closed seed financing and can hire a part-time accountant. You may wish to sign up for Carta for the cap table and Quickbooks for the accounting. You may wish to open a payroll account, for example with Gusto. (You do not need worker’s comp at first. Once you have employees who are not founders, then you will have to sign up for worker’s comp.)

- A checkbook from the bank will eventually arrive in the mail.

- Having tried both virtual and physical offices, it is strongly urged that you pay some rent and bring everyone together in one office.

- Set control points for the organization and communicate to your staff in writing. For example, set these four rules: you are the only one with bank access. You must sign all offer letters and contracts including all NDAs. You need to sign off on any purchase over $1000. You will only reimburse expenses over $25 if there is a written receipt submitted.

- Make sure any person hired receives a written offer letter and signs an Employment Agreement that includes an IP Assignment clause.

3: How to Create Value Before You Raise

Why You Should Approach VCs Last

Should you pitch your raw idea to VCs and let them tell you if it is any good?

No!

Way too many founders approach investors first. Seeing VCs first will deplete your credibility. Either you don’t even realize you are too early and you are an amateur, or you do realize it and you are too lazy to do your homework. Either way, they will not be impressed by your premature pitch, and you will lose credibility.

Investors are sixth.

See customers first, add cofounders second, add advisors third, recruit vendors fourth, and win investment interest from 2 or 3 angels fifth. Now you are ready to pitch VCs.

If you already know a friendly founder or investor, it’s OK to approach them earlier than sixth, but for networking and advice, rather than for money. (Our VC fund Pillar loves to see people who are still figuring out their plans). Show them an invention and ask for help building a company to commercialize. Or, if you are on the business side, tell them you are interested in starting up a company in a certain space (e.g. gig economy, VR, pets, space satellites) and ask the VC if he or she is looking actively at projects in that area. If so, ask if the VC might be open to have a 30-minute intro meeting to share perspectives and for networking. Either way, hopefully the VC will help you find a cofounder. Then go do all your work to validate a specific idea, and of course come back to discuss the plans that emerge.

The saying “ask for advice when you want money and ask for money when you want advice” is among the most accurate proverbs in start-ups.

Wait to formally pitch your idea for investment until after you have figured out the answers to those 4 simple questions and discovered an actual Good Idea and you have enough of a team to get started. Until then, your company is NOT investable and the pitch will miss. Miss enough pitches and the word will get out – VCs won’t even want to meet you.

So instead of seeing a VC, go after the idea on our own for a few months on a shoestring, and show an ability to make real progress using your own personal resources.

Prioritize Your Day By Greatest Risk

At the start, your to-do list will be endless. It can feel overwhelming. Time, even more than money, is your most precious asset. So, how should you prioritize?

To think about this, consider that your company has multiple types of risk:

12 Types of Risk

A. Tech risk: does our innovation actually work?

B. IP risk: are we infringing on patents of others or failing to properly protect our own IP?

C. Development risk: do we know how to develop a scalable product?

D. Operational risk: can we provide the product at the target quality, cost and capacity?

E. Product-fit risk: do we know who the customer is and what they will buy at what price?

F. Channel risk: is there a cost-efficient way to attract customers and sell them the product?

G. Regulatory risk: is what we are doing compliant with all laws and permits?

H. Competitor risk: will an established player launch a similar product?

I. Team risk: will the team get along and work well together toward the goals?

J. Hiring risk: can we get the people we need at the time we need them?

K. Financing risk: can we raise all the money we need, even in bad times?

L. CEO risk: does the CEO have leadership and management ability?

Imagine that these are all separate, independent risks. Now here is the key: any one of these risks could kill the business. Failing on just one of these dimensions will halt your company’s success, so you have to solve them all.

It's all or nothing.

Use this formula to estimate your company’s chance of success. Your overall probability to succeed is the chance of beating the first risk, multiplied by the chance of beating the second risk, multiplied by the third, and so on for all twelve types:

A x B x C x D x E x F x G x H x I x J x K x L = OUR CHANCE OF SUCCESS

Any single risk with zero percent probability of success puts the expected probability of success for the entire enterprise at zero, no matter how well you are doing in the other factors. Investors call those knockout risks.

Here we see why start-ups face long odds. Even if you feel 90 percent likely to succeed against each of the twelve risks, your chance of beating them all at the same time is 90 percent multiplied twelve times or 28 percent (which happens to be the average rate of venture-backed start-ups returning their capital). But what if just one risk has a 25 percent chance of success instead of 90 percent? The total chance of success drops to just 8 percent, long odds indeed.

Investors run these numbers in their heads instinctively. The point of diligence is to identify the potential knock-out factors as quickly as possible. A low chance on any single area means big risk for their money, and they either walk away or demand a low valuation.

What can you do today that will have the greatest impact on your value? The best factor to improve is whichever factor is closest to zero.

Prioritize each day to focus on your current greatest risk to the company’s success!

To make this actionable you need to rank your risks. Do it now and order each risk on the list above from most concerning to least. Ask a co-founder to do the same. Do your work separately so you avoid group think, and then get together to compare.

When companies pitch us at Pillar VC and we think we may invest, I challenge the founders: “Everybody pull out a piece of paper. Imagine that after we fund you, one year later, we had to shut the company down. How sad! Now imagine, what could have caused that? What happened? Everyone, please write down whatever risk immediately jumped to mind.” Then we compare the lists and discuss.

Sometimes you will realize you have no idea how to calculate a risk factor. Then you owe it to yourself to fill in your blind spot as soon as possible. Call around and ask others for an assessment. Bring on co-founders, hire part-timers, and recruit mentors and advisors as needed.

Once you have an accurate ranking of your top risks, figure out what you can do to address them. You might:

Reduce Risk and Thus Create Value

A. Tech risk: run experiments or write code to show feasibility of meeting key criteria

B. IP risk: conduct an IP search; file a provisional

C. Development risk: write dev plan; obtain outside review; develop working modules

D. Operational risk: develop cost model; obtain vendor quotes; benchmark

E. Product-fit risk: visit customers; develop prototypes and gather feedback

F. Channel risk: interview distributors and experts; run test ads; sign marketing partners

G. Regulatory risk: confer with lawyers; obtain permits

H. Competitor risk: identify competitors and their goals, monitor their activities

I. Team risk: bring the team together to work on values, discuss goals; show joint output

J. Hiring risk: identify super people ready to join for reasonable compensation

K. Financing risk: obtain investor commitments; keep valuations reasonable

L. CEO risk: write a clear vision, clear budget, clear plan and make progress on all above

Notice how many of these actions require fairly little cash to dramatically raise your odds.

To organize your day, identify the top risk on that day. Then figure out the best action you can take right now toward lifting your chances. Repeat that every day and your venture will increase as rapidly as possible in value.

It’s tempting to focus on the easiest tasks. Successful leaders must do the opposite. Head straight toward your worst fears! If you run into a roadblock, you want to know that early, so you can pivot before you waste even more cash. Do it now while you are in the seed round and your burn rate is still low and investors still expect some pivots and changes.

The model that you had in mind at the start inevitably will have some bad assumptions. You must not cling to these assumptions. See the world as it is, not as you wish it would be.

Building Value with Advisers

One cheap way to drive up your perceived value and chance of success is to recruit a few famous experts and well-known industry figures to help. They can become Scientific Advisory Board members, consultants, strategic advisers, Customer Advisory Board members, or even independent Board Directors.

So before you raise cash, go recruit a few of these luminaries. Not only will they give you practical advice and customer referrals, their stature will elevate your start-up. You gain credibility and value. The fact that you could recruit such busy people is a sign of your sales ability and competence.

Deciding on a Capital Source

To start a company does not require technical or scientific innovation. You can build homes, start a restaurant, import a foreign product, buy a franchise, open a distributor or dealership, start an ad agency, create a new food product, open an eCommerce site.

These ideas bring less technical risk, which is good news. Some can be started solo or as a family business. The hurdle is that there are many direct competitors. It is much harder to achieve breakout success.

These are good companies if you are young and can hustle, and you are ready to devote many years to build patiently to scale. They are get rich slow opportunities. So take care to finance these companies with friends and family capital, not with venture capital. Do everything you can to maintain majority ownership so you will not have to sell early. Reinvest your profits year after year. This path can build as much or more wealth as a very successful start-up as long as you avoid dilution.

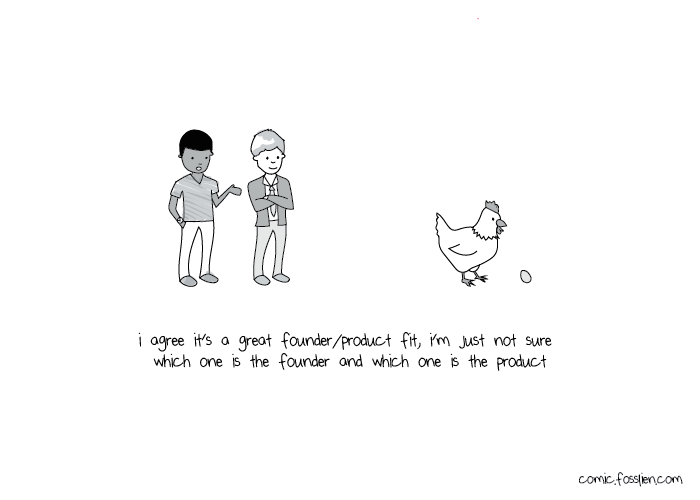

We should make a distinction between a traditional business, like opening an office building or a restaurant, and a “high-potential” reimagining of traditional business like WeWork or Blue Apron with their fresh approaches to commercial real estate and grocery stores. Those kind of start-ups were innovating a new business model, jumping onto trends toward the two-income household and eCommerce. They had to raise venture capital so they could move quickly and capture a window of opportunity.

Let’s say that you do have a highly innovative idea. Even then VC may not be right for you.

Start by evaluating the time pressure on your idea, the size of the opportunity, and whether the company is within say 2 years of revenue.

If you are in a tech field, racing against competition, and you have a big opportunity, and the product can be shipped in less than 2 years, then you are suitable for venture capital.

If you have an idea that is a bit niche, the opportunity is a bit smaller, the technology is rawer and the product launch is a bit further away, the management team is young, or the whole venture just seems a bit riskier, then you are suitable for angels to get started; maybe VC later.

If you have no fierce time pressure and the product is not too expensive to develop, then you can bootstrap or try to raise a minimal amount of money from friends. A successful way to bootstrap is for the founders to take unrelated consulting jobs while they develop their own product.

If the technology is more than 2-2.5 years from launch and still unproven, then stay in your research lab. Or wait until you can get SBIR or DARPA funding before your spin out.

Kickstarter is best delayed until your product design is complete and you are ready to move into pre-production. The early orders will help you secure vendor support and hopefully kick off a viral marketing campaign. Some founders get into trouble when they use the Kickstarter cash for design and engineering, and then they often run out of cash when it comes time to ship.

In terms of the seed fund-raising process, there is a lot of advice out there already for pitch decks. I won’t try to re-create it here.

Prepare a pitch deck. Find a list of angels, see which ones have backed deals that look like yours without being directly competitive, search LinkedIn to find a common contact and get a warm intro. Send then your pitch deck. Offer to meet. Meet. Ask for feedback and advice. Repeat.

If you take more than 5 meetings without ANY interest then stop. Go back and reflect on the advice you heard. If necessary call people for feedback. Improve the idea; improve your pitch. Then try again.

The general point here is that investors are usually seeking particular types of risk, usually have a timeline in mind to receive their money back, and vary in disposition from the passive to the active. Make sure to pick a capital source that matches your situation.

4: Create a Slide Deck with This Format

The most classic and helpful pitch format explains what you are doing in “problem-solution” style. Prepare 10 slides in this order:

- Vision – your company’s impact ten years from now

- Team – who you are (with credentials that show you are well-suited to the task)

- Problem – what is the burning customer pain?

- Approach / Solution – your innovative product or service and its value to the customer

- Business Model – how much money you make on each sale

- Market – how many sales you can make over time

- Competition – who else wants to service your customers and why you are better

- Go-to-Market – how will you acquire customers?

- Plan – what are the key milestones ahead?

- Financing – your monthly spend for next 18 months and how much you want to raise

When you are done, hire a graphic artist to give it polish and flow. The visual quality of a business presentation matters more than you might imagine. Having an editorial eye that organizes ideas and eliminates clutter is a way to demonstrate that you know how to prioritize. Keep it simple, clean, clear, attractive, lots of white space, readable font sizes. Deliver just one point well on each slide. If you don’t want to hire an artist, Dave Balter suggests “Get to know Unsplash and 500px and your slides will do the work for you.”

Once this is ready, reach out to friends and find your way to local angels or seed investors and set up in-person meetings.

5: Start Delivering Your Pitch With a Story

Since people’s minds differ, you should be communicating in multiple ways at every pitch.

- Some people need to see it – so always show your slide deck.

- Some people listen for words – so practice your voiceovers.

- Some people love numbers – so bring a spreadsheet (not a graph).

- Some people need to touch – so put a prototype in their hand or show them a demo.

- Some people are visionaries – so make your dream real with an image or analogy.

What seems to work with nearly all people is stories. So every great pitch tells a story.

What seems to work with nearly all people is stories. So every great pitch tells a story. Start with your own histories and how you got excited about the concept and why you are the uniquely perfect team to start this company right now.

Then tell them the story of a customer.

Boring pitch: there are 12 million regular tennis players in the United States. Tennis is a $5.6 billion economy according to the Tennis Industry Association. What an enormous opportunity for a robotic tennis machine!

Better pitch: Meet Sue (smiling pic of Sue on a tennis court). Sue is a tennis nut. I know because she’s my mother! Mom plays three times a week and all her friends play too. She has spent thousands on lessons. She has a tennis wardrobe, fancy tennis shoes, and she belongs to a tennis club. The way the company started is after she lost a tournament match to Beth. Beth is that player – that player we all hate – who always shows up late, calls your shots out when she thinks she can get away with it, and if you lob one past her she says the sun was in her eyes. Mom hated losing to Beth! And she resolved never again. That’s when I came up with…

With the first pitch, you sound like a dry MBA. With the second, we can feel the eagerness of the customer, and we understand why this has become important to you personally and why you might have the tenacity to stick with it for the next decade to build a company of importance.

Or, tell them the story of an industry.

Boring pitch: we sell software for managing sales forces

Better pitch: we are leading the transition of sales automation software into the cloud

There’s a wonderful exposition about this called Great Pitches Start with Change, and Salesforce is a strong example – see Marc Benioff’s book Behind the Cloud.

Start the pitch by connecting emotionally. Then people will care to hear the facts and figures.

Practice Makes Perfect

GREAT CEOS PRACTICE THE PITCH AT LEAST 20 TIMES BEFORE THEY START IMPORTANT INVESTOR MEETINGS. This can be alone, to the pigeons in the park, for friends and current investors, or it can be with Tier III investors who are long-shots or slightly out of your target zone so you can “break some eggs” as you refine the message.

Once you have the pitch in your bones, you can go in ready to deliver a great talk without a lot of mental energy, which allows you the extra bandwidth you need to watch your audience as you talk. Be ready to go off script as needed, adjusting to the style and interests of the person listening to the pitch. You will be able to do this best if you know your material stone cold and don’t have to think about your talking points.

A presentation method that works well here is an “accordion” style. Be able to explain each slide at three different levels, and then compress or expand as time allows.

The compressed version should be just one declarative sentence per slide. Let’s say you have a bar chart. Perhaps you can show the slide for a few seconds and simply say “Heavy Email Users Want More Speed” and the VC nods along. Flip.

Make it easy on yourself and just use that sentence as the title for each slide. You can flip the entire deck at this level in less than 5 minutes. This title tactic is also endorsed by Eric Paley here.

Imagine you fly out to San Francisco and endure the traffic and you get to a key meeting and the VC announces that he or she has a fire drill and can only spend 20 minutes with you today after all. Inside, you are mad and flustered! But you are not defeated. As you grapple with these emotions, you stay right on track by just explaining your bio (2-3 minutes) and then flipping your deck, reading the titles slide by slide. You are done by minute 10. Wow you look hyper-organized and used only half the time! After the VC realizes he or she is actually looking at a hot deal and a competent CEO, the VC can follow up.

If you make your titles like this, a key benefit is that anyone can read your deck and understand your message without you standing there to explain the slides. It is important that the deck stand on its own.

The medium-speed, normal version allows one minute of talking from you per slide: “We interviewed 150 heavy email users and asked them about 8 different reasons why they would consider changing software, and this bar chart shows the top reason each person selected as a percent of responses. As you can see, a staggering 40% of heavy email users are eager to try a new email client that would save them 15 minutes per day. So that’s where we focused our product development effort for the past year. I’m sure you would like to see the results! (flip to next slide to discuss beta user testimonials)” This is how you would present the slide if you have a one-hour appointment. First there is a comfortable 5-minute start, then twenty slides at one minute each allows for 20 minutes of you talking, and then plan for 20 minutes of friendly back-and-forth discussion with the VC during the pitch, and then 15 minutes of feedback and conversation and planning for next steps at the end.

The expanded, 3-5 minute version for each slide gives you room to add a colorful story or anecdote if the chance presents itself. You don’t have time to tell 20 stories for the 20 slides, but when you do see the audience is very interested in a topic, you can tell that story. Let’s say you hear a VC ask “How did you collect this survey data and what else did you learn?” Now you know the VC is interested in market research (!), so let’s dive in. “This data comes from the trade show where we asked people to rate their email use and focused on people who send 100 emails and up per day which qualified them as heavy users. Then we scheduled a follow-up visit to their place of work. We watched how they checked and answered their email, then asked them questions according to a structured guide. So many mentioned time pressure! (VC nods) Let me tell you about Lucy. Lucy works as a real estate agent, and when she gets an email from a prospective client, she has to respond within a few hours to have any chance to get the business. Her problem is that she is often squeezing in her email replies while she is parked between appointments. So, she needs a quick way to screen her mail and tag some to handle that evening, some for her assistant, and then she can easily see what’s left that needs immediate attention.” This story really impresses the VC both for its content and your diligence.

Across all your slides, memorize your key numbers. Interested VCs will ask lots of probing and what-if questions and you need to know your numbers to be able to answer on the fly. Great CEOs know by heart the sales targets and headcount targets for every month for the next 12 months and every year for the next several years, and they obsess about their business metrics like CAC, LTV, commission rate, ASP, days receivable, average salary for different positions, and so on. Such numbers are vital to building an actual company and so your modeling them in advance and internalizing the targets is a sign of operating competence and readiness; not knowing them is a sign you and the project are still green.

As you practice, bring a co-founder or teammate with you to help watch the audience and take notes. Write down every question you get. Then go back later, and polish your slides, re-order, and develop new materials so that the next audience will be less confused and more convinced.

6: Research Your List

The greatest factor that can reduce the effort required to run the process is to invest heavily in researching your targets before you start scheduling meetings.

Why?

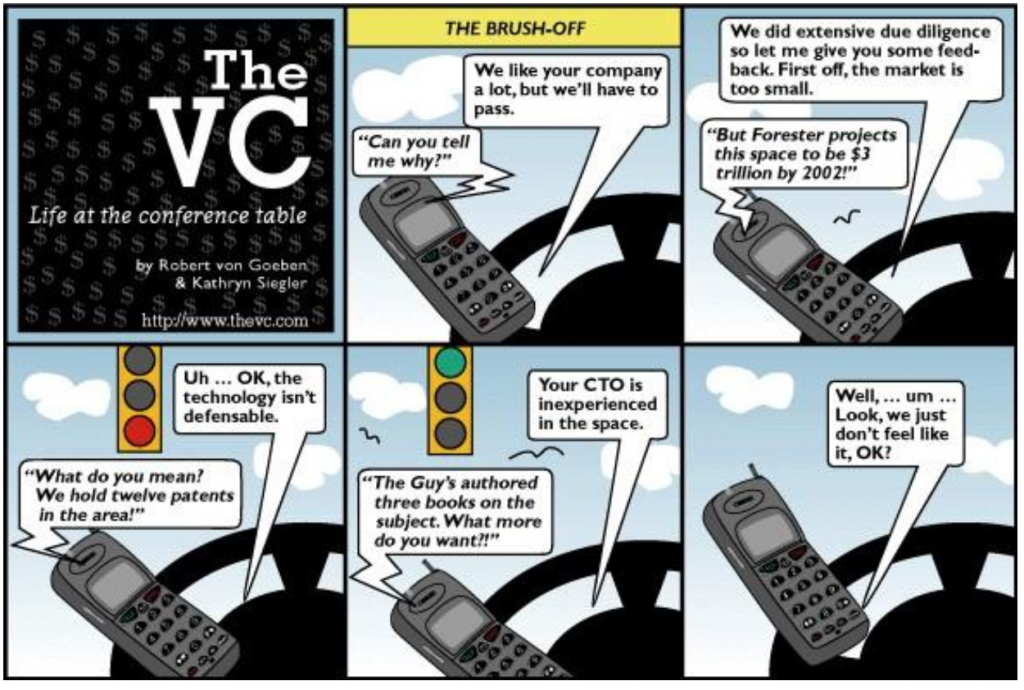

The typical VC will lead just 2-4 seed deals per year. Think about that… they review hundreds of companies and give out perhaps 4 lead term sheets per year. These numbers are even lower for Series A and beyond.

VCs have limited ammunition and can only pull the trigger a few times per year.

Because of this need to select, VC partners are extremely fussy. It’s not just a question of whether your company will make money, but also a question of whether your deal will make them more money than hundreds of other choices.

For Series A, as the check sizes get large, VCs will often specialize on particular sectors. However at Seed stage, checks are smaller and VCs tend to be more general on field while specific on the early stage. Seed VCs also expect to spend a lot of time with you, and so it is usually best for you and for them if your lead seed VC is based in the same city and can come over to see you in person as needed.

To avoid wasting your precious time and energy, invest 10-20 hours of research to create a list of targets who lead seed stage investments in your city.

Narrow it down rigorously before you ask for introductions, and be cautious about accepting well-meaning but unfiltered introductions. Protect your own resilience in the future by screening every target carefully now.

You can start by looking up other start-up companies in your city who raised Seed recently. Who were the VC partners (and you need to look at partners, not firms) that led the round for each?

This takes elbow grease! To get you started, there is a partial list of Seed VCs organized by specialty on Signal. You also can find records of Seed financings on Crunchbase, Pitchbook, Google, the SEC (many Seed deals are recorded with publication of a Form D), the business press such as TechCrunch, Xconomy, Forbes, VentureBeat.

Screen aggressively. There are also a lot of VC funds out there that say “early stage including seed” but really focus on Series A or later, or who do not have any cash left, or that have not actually started making investments because they are still raising capital for their funds. None of these are relevant to you.

Cross out anyone from a VC fund that is “about to close”. VCs without money will still take your meeting (!), because they want to show potential wealth capital sources they have good, fresh deal flow. These people waste your time.

Cross out anyone from a VC fund who has not actually led and closed a Seed deal in the past 180 days.

Cross out anyone who works at a VC fund that is already backing one of your direct competitors.

For all the partners remaining on your short list, carefully review their Medium blogs, LinkedIn posts, and Twitter feeds and also cross out anyone who turns out to be a poor fit for your company. For example, you make hardware and they say in a podcast “we never invest in hardware.” Believe them and move on.

Next to each remaining partner on your list, use your research to write down the reason why you think they could add value or see a connection to your company. “Sue backed TripAdvisor, so may be interested in our site that collects user-generated content.” “Beth has a PhD in materials science and we are developing a new material.”

Prioritize into three levels: Tiers I, II, and III.

These are about volume of deal flow and signaling the quality of your company to future investors.

Now prioritize into three levels: a Tier I list of strong-fit prospects at the most famous firms, a Tier II list of other highly appealing prospects from reputable funds, and a Tier III list of partners who fit on paper but work at regional, less well-known, small, or family office funds. Note that these tiers are not about partner quality or fit with you, but about volume of deal flow and signaling the quality of your company to future investors. Your chances are lowest at the Tier I firms because they are mobbed at all times, however, if you can win a term sheet from one, then this is a strong positive signal to everyone else.

Screen each VC firm before you even ask for the meeting. What are they saying about their investment strategy on the website and on their social media? Who is in their portfolio? What was their most recent investment? And why is the background of the person you are asking to meet a good fit for your project?

Corporate VCs come with baggage that make them too complicated to be good lead Seed investors. Save them for Series B and beyond.

Finally, put your list in a Google Sheet or Airtable document and share it with any angels or advisers for comment and refinement. Create columns and as with any pipeline, track your targets by entering the date you achieve each step: intro scheduled, first call, site visit, due diligence, received pass, received term sheet.

You will soon fill those columns!

7: Begin Reaching Out

Begin with Tier II prospects. Select 10 of them and for each one, use LinkedIn and consult your advisers and angels to figure out how you can get a warm referral.

Referrals are critical. VCs are swamped by mediocre pitches and eager to ignore founders who do not have sales skills. If you can’t figure out how to get a warm referral, they will safely assume you do not have what it takes to succeed.

Referrals are only valuable when made with actual credibility and enthusiasm.

Referrals are critical, but referrals are only valuable when made with actual credibility and enthusiasm.

The most valuable referral you can get is when one of the VC’s existing portfolio CEOs knows you well and can vouch for you and your business.

Otherwise ask anyone you both know well enough in common to vouch for character in both directions. Ideally bring the referrer through your deck first, so that the referrer can truthfully say “I think this is a great person with a great idea.” The VC will pay more attention.

Next most useful, would be asking your current Seed investor for a referral, ideally a Seed investor who is bullish and wants to take more than pro rata.

The least useful is a referral from anyone who hasn’t actually seen your pitch, or doesn’t actually know the investor well enough to have mutual trust.

Your referrer may well ask you “send me a blurb I can forward.” A common mistake is to then try to pack in tons of information that will take 10 minutes for the VC to read. That is a book, not a blurb, and likely will be ignored.

Send no more than one paragraph! All you need to do is intro the topic enough for the VC to see if the deal is in-scope and relevant to his or her interests. If so, you can be sure he or she wants to review your deal and will take the time to read the intro deck, which is your goal.

Just give the headlines: “Elon is an experienced deeptech CEO who already has several big exits. His next company Tesla is developing the world’s most beautiful, reliable, safe, and fuel-efficient electric vehicle. The team has strong pedigree and industrial scale-up experience. Although an automotive start-up sounds capital intensive, they have a clever asset-light model to get into production plus a creative direct-to-consumer sales approach. They are raising a $8M Series A and all of the Seed investors – including impressive seed investor X – want to participate. Have attached their intro deck below.”

That’s it – six sentences is all it takes and all you want.

Your referrer will then forward that to the VC along with your deck and check interest, and if the VC has interest, will introduce you to each other.

Some VC partners – a high percentage if you have done your homework well – will immediately reply “Sure please make an intro” and your referrer will do so. Any who reply “Sorry out of scope, we don’t do deals like that” is crossed off the list.

You may see some partners delegate the deck “Thanks I am forwarding this to our associate Paul who loves cars.” It is a great mistake to become arrogant and demand that you must speak with a partner! Do not try to dodge the associate – that will create ill will. Instead, take any meeting graciously and pitch your best.

You want the associate to become your ally and champion within the firm – someone who can help make sure you get onto the partner’s calendar and stay top of mind. Associates are plenty eager to find great deals to bring forward, so if you have any shot at all, they are certain to mention you to the partner, probably in a 3-minute exchange that sounds a lot like the blurb with added color. Partners also rely on associates to describe how you come across as a businessperson – do you feel likable, competent, and driven; or inarticulate, unprepared, or stubborn? A brief “forgettable” or “impressive” makes all the difference as to whether the partner will pursue. Finally, associates know the partners very well and if a partner seems disinterested, associates will know if another partner might fit better. Take these meetings seriously, and treat the associates with respect.

(NOTE: not all CEOs agree – those who do a lot of fundraising feel that associates are time-wasters. Sure, if you are a serial founder, you may have the reputation to let you skip associates and go straight to partners, but if that is not you, just do the work and take the extra meeting. It’s fine.)

Principals are between associates and partners. Some principals have the authority to lead a deal; some can follow but will not lead; some work closely with a particular partner as a force multiplier. The same can be said for Venture Partners. Again, place no importance on titles. Take any meeting offered to you seriously and treat everyone with respect regardless of title.

It sometimes happens that you are simultaneously introduced to two different people at the same firm. That’s OK but you should immediately alert both parties “P.S. just realized my network has passed this to both of you in parallel, so if this is of interest to Firm X, please let me know who is best to meet first.”

During your first call, seize the chance to qualify the prospect. Confirm whether the VC fund is actively leading Seed rounds. Ask the person “What is the sweet spot investment for your firm?” and find out what kind of investing they typically do. Ask “what are the last three deals you did?” and see if they sound anything like your deal. If you discover they do NOT normally lead deals or invest in your area, then put off further meetings until after you find a more suitable lead.

8: Pitch Meeting Basics

Arrive 10 minutes early, not more. After you get to the conference room, avoid the temptation to stare out the window. Immediately plug into the projector and confirm that your slides / WiFi / demo are working.

VCs appear relaxed and offer you coffee, but don’t show up to a pitch meeting planning to have a casual chat. Your VC is a professional and your time with them is limited. Remind them what your company does right at the start, because they take so many meetings. Allow five minutes of casual discussion to warm up, then introduce your bio and how you came to the project because they need to get a sense for who you are and to imagine whether they would like to back you as a person before they can concentrate on the details about the company. Then adjust your pitch pace to use up about half the remaining time, which leaves the other half open for Q&A along the way or at the end.

Always put your slide deck on screen, because some human beings need to hear information and other human beings need to see information, and you don’t know in advance which types will be in the room. Speech plus visuals delivers more information per second than speech alone, so it is most effective to broadcast on all channels simultaneously. Bring a small bag of connectors as necessary to be able to immediately adapt to the room.

Let’s also hear how Dave Balter suggests taking these pitch meetings:

“Pitch live when you can. Pitching via video works, too (zoom finally made this work well enough). Don’t pitch on a phone call. Always pitch with a deck. Pitch in an office, not a coffee shop. Pitch without Randos walking behind you all the time (no one cares about your shared office space).”

You want to come across self-confident, but not self-centered. Tod Loofbourrow adds further advice on style: “Avoid hype and pressure tactics like, ‘you’re gonna lose the deal’ because these sound arrogant and will be red flags to investors. Remember, both sides are trying to build trust. Trust is built over time. VCs have a real need to assess each CEO. They wonder: Are you coachable? Do you put the company’s success ahead of your own ego? First-time CEOs think they need to be the smartest person in the room and have all the answers. Experienced CEOs would rather be smart, collaborative, and humble; a good listener who can take feedback well and does use it to improve; and secure enough to bring in great talent.”

9: Handling Tough Questions

Here are a few questions you will get often, and how best to answer:

Q: What is your vision for the business?

Bad Answer: I want to flip it for a quick profit next year.

Good Answer: We will work tirelessly until we put a Coke within arms reach of every person in the world.

Q: After the round closes, who are your first three hires?

Bad Answer: a secretary, a customer support rep, and my brother who is a really good engineer

Good Answer: a world-class VP Marketing and 2 sales reps with golden Rolodexes, followed by a VP of Operations, and then a few months after that a VP Finance to upgrade our part-time CFO. (you have carefully thought this through in advance! you are greedy to hire the best people in the world!)

Q: What keeps you up at night / what is your greatest risk?

Bad Answer: nothing / the greatest risk is raising enough capital from investors

Good Answer: we have discussed this a lot. Our top three risks assuming we do get the capital are 1, 2, and 3. That is why during the seed we will do ____ to resolve 1; and ____ to scout out whether 2 will turn out to be a problem. We will then turn to focus on 3.

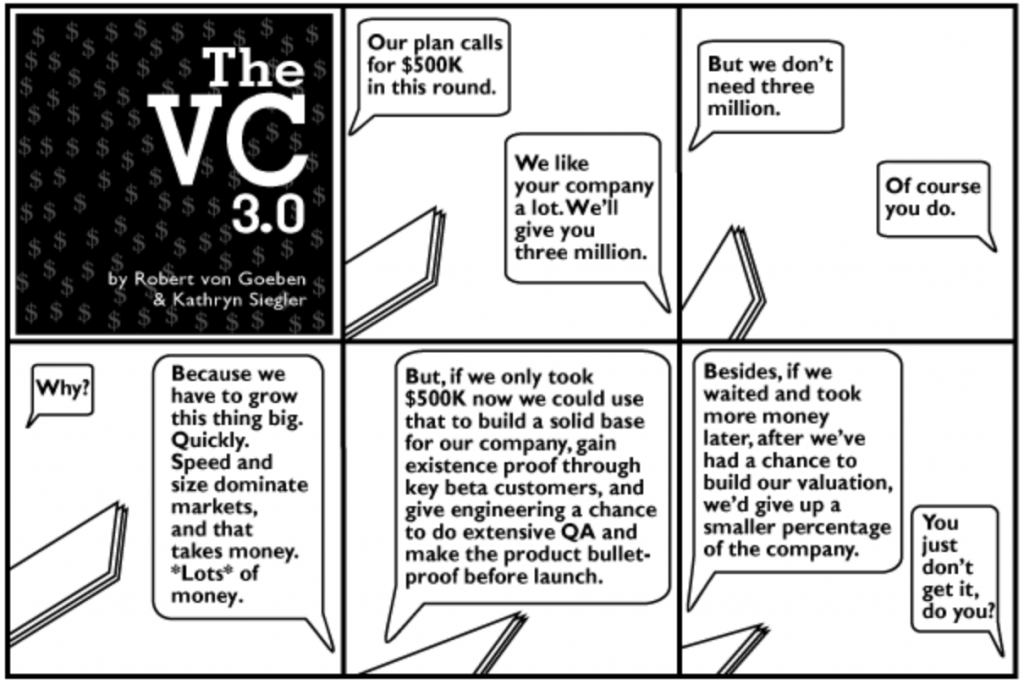

Q: How much are you trying to raise?

Bad Answer: we want to raise $20 million (you need $10M; hope VC offers half)

Good Answer: we need to raise $8 million to get to milestone X. If the syndicate supports then we would raise $10 million and get to milestone Y.

-> Approach your target size from below so you are sure to exceed expectations

Also, take a moment to learn the word “syndicate” – it refers to the investors as a group. This term is used frequently in finance.

Q: How do you want to see the round come together?

Bad Answer: two new VCs plus the insiders (bad answer because you don’t know if this investor is willing to work with a co-lead, you don’t know if there will be another interested VC to join, also you have just made life more complicated for everyone because there will need to be more heads around the table)

Good Answer: we want to pick the right lead partner and then work together to figure out the best and most compatible syndicate.

Q: Are your insiders participating?

Bad Answer: we haven’t asked / they are still deciding / it depends

Good Answer: yes they will take about $2 million assuming typical valuations and a credible lead

Q: What are your valuation expectations?