Home// Articles// Starting a Company// 10 Principles for Success in University Spinouts

10 Principles for Success in University Spinouts

Russ Wilcox

Partner at Pillar VC

Russ Wilcox

Partner at Pillar VC

Spinning out a deep tech company from a university is no walk in the park. Follow these 10 key principles to maximize your chances of success.

1. Stay in the University Lab

as Long as You Can

Take advantage of the resources available to you at your university.

Whenever possible, stay in your university’s lab for as long as you are able, and take advantage of the resources available to you there.

Not only does staying in the lab reduce your need for capital and protects your personal savings (no salaries!), but you can also meet customers, develop the plan, and recruit a robust team all while still in the lab.

If you need a university license, it’s also “free” to add IP, meaning, if you’re already licensing two patents, the university will still try to charge you as much royalty on the full package vs. getting royalties on additional licenses down the line. In other words, they will charge you the same royalty whether you have 1 patent or 21 patents.

Finally, staying in the university lab allows you to find out whether your product works, or whether pursuing this company is right for you— all BEFORE you have to raise money. Once you take a check from an investor, there’s no quitting without major reputational cost.

2. Find a Bold Hook

William Sahlman, Baker Foundation Professor of Business Administration at Harvard Business School, once said, “Investing is a horse race between greed and fear.”

Marketing matters. Packaging matters. When you’re seeking investors, “make sure they know the juice is worth the squeeze.”

To balance the fear created by technical risk, emphasize a “Holy Grail” outcome in your messaging.

A “Holy Grail” outcome might look like:

- A sheet of paper that can print itself

- Infinite clean energy, cheaper than coal

- A first-in-kind cure for cancer

Balance the fear created by technical risk with a "Holy Grail" outcome in your messaging.

Clearly, “Holy Grail” outcomes are difficult to come by, but reducing the perception of go-to-market risk allows more room for science risk.

3. Raise Money Aggressively,

But Don’t Overhype

The vision is what draws investors in. You should emphasize the vision to attract more cash, but you should NOT exaggerate to justify wild valuations.

Even late-joining investors paying top dollar expect you to grow their value. If you don’t ALSO believe you can do that, you should not take their money.

If you overhype ANY round, you win in the near term but make ALL future fundraising harder. That raises the odds of a down round, perhaps years later, making you lose in the long run.

During a down round, you may get refreshed back partway, but you will likely have to restart your vesting clock. You end up worse off than just taking a rational valuation.

4. Hire a Diverse Early Team

In your first hires, you want to find people whose strengths are complementary to your own and to each others’. Diversity of perspective is the root of creativity and the coin of your realm. You can’t avoid the problems in your blind spots!

Your first 10 hires should be the most orthogonally different you can find. Make sure you have both commercial and operating DNA in the company early on. Your goal should be to get all disciplines around the table together.

5. Revenue is the Enemy

(at the start)

Once you start shipping product, you forget everything else.

Why? Customers are like babies— they need your constant full attention.

Plus, once investors see you have revenue, all they reward is immediate growth. As soon as you start being measured on revenue, it’s a lot harder to focus on innovating. Instead, you will need to build out your sales and operations team. While important, building a sales and operations team will absorb 90% of your cash and deplete all your mental energy. Don’t cross that threshold until you are ready.

Define proxies other than revenue for each round. These allow investors and employees to feel that the company is making progress and on track.

6. Plan Intensively,

Replan Often

A key difference in running a deep-tech company is that each change in strategy adds 2 years to your build.

While it’s easier said than done, you should follow this advice:

“Don’t skate to where the puck is, skate to where it will be.”

Competition is less like fencing, and more like a naval battle from the 1800s. Mistakes are costly! You must think through risks in advance and prepare contingencies. You better be right on the application— you can’t afford a product-market miss.

In the early stages, to prevent a product-market miss, you should:

- Prototype and communicate with customers often, even years ahead

- Force re-examination of assumptions with each stage of product development

- Deeply model the sales forecasts, building adequate capacity years in advance

- Sweat the details of every contract, every inventory order, and every supply agreement

7. Pursue the Most

Infallible Product

a. Pick the Application Fastest to Breakeven

It is really hard to enter a second application space— far harder than it looks.

You should focus on finding one market that is big enough that you can reach breakeven on one product. If you see more than one, pick the path of least resistance to breakeven.

After you start turning a profit, time is on your side, and you can exploit the remaining opportunities at your own pace.

b. Don’t Settle for Nice-to-Have

Customers generally view products as one of four types:

Oxygen: TOO vital… customers will never rely on a flaky start-up!

Aspirin: Eliminates a real pain for customers, so they really want this.

Vitamin: Desirable, but customers can drop it if needed.

Jewelry: Only relevant when customers are in the mood for and able to splurge.

A vitamin helps the customer achieve a small cost savings or convenience, or moderately expand sales. It’s good, but it’s not urgent. That can make it very hard to achieve your sales plan, and if your start-up stumbles, they may simply walk away. Jewelry can work, but jewelry customers are fickle, and it’s hard to know in advance if you will catch on and become a fad. These products are nice-to-have but are not reliable. It’s the gambler’s ruin problem— if you are constantly betting at a disadvantage, you will eventually go broke.

💊

It’s the aspirin that will bring in money.

Customers are willing to pay and take a chance on you if you can eliminate a real pain point for them. Don’t settle for the nice-to-haves— you need to find your “aspirin.”

c. Be Cautious to Launch a Platform

The benefit of launching a platform is you don’t have to invest in a full product or downstream channel. The danger is that a platform by itself does not create value, so there’s the risk that no one adopts it.

Strong examples of platforms include Stripe and Twilio because collecting payments and messaging are common demands for many applications. Compare that to offering a new software language that people don’t already feel they need.

Ask yourself: Do customers already have a budget and want to buy? If so, build an efficient platform, and third-parties will adopt. If not, it’s better to sell a whole product that delivers value on day one

The easiest way to launch a platform is to serve an existing end demand.

d. Look for Gaps in Existing Product Lines

Compete head-on. If you’re looking to compete head-on, the benefits are the market exists and the product exists and you are sure the budget exists, because you are knocking out one of your competitors. The headaches are the margins are usually tight, the requirements are fairly inflexible, and the competitor is likely to fight you for the business.

Expand a product line. If you’re looking to expand a product line, the market exists, but you enable a new product. You expand the product line. You do have to pitch the customer on investing in a new product SKU.

Create a new category. A third option is to create a new category entirely. But remember, it’s a $0B dollar market at the start, so your first couple of years will likely not have any orders and it can be a long road ahead.

We recommend shooting for the product line expansion, and avoiding creating a new category as your first application.

8. Narrow Your Scope

to Reduce Your Burn

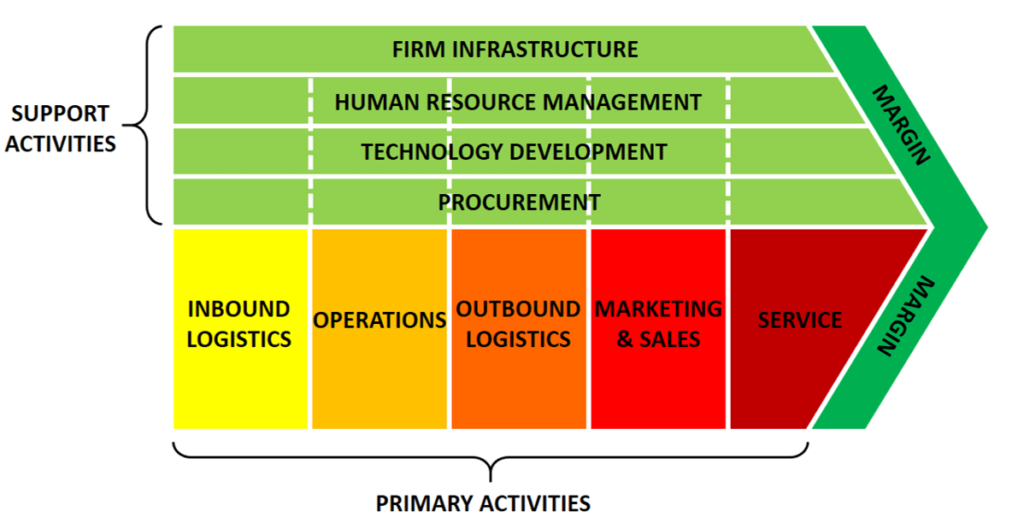

Outsource all steps that you can, while capturing the bulk of the value. Conduct a value-chain analysis (seen below), and ask yourself at each step, “Will our excellence in this step be attractive to future acquirers?” If it’s not, don’t bother investing, just outsource.

If the aspiring founder seems overly in love with a precise plan, I give them the “lucky or wrong” talk, which encourages them to learn and adapt. A diminishingly small number of companies succeed with the plan they started with.

If the aspiring founder has forgotten the business model in their version of what they will create, it’s time for the “if we win, we win” advice. Which is to say, you are doing something really hard. Make sure if you do succeed in solving this really hard problem, there is a great business on the other end of it."

9. You Only Get One Launch

Be ready to cancel.

Cancelling a weak product is a setback, but survivable. Whereas launching a weak product will kill the company. Why? A launch will eat all your money.

For every scientist, you’ll need 10 engineers. For every 10 engineers, you’ll need 100 people for the rest of the business (sales, marketing, etc). Meaning, a launch is expensive!

Before you launch a product, you should:

- Scout widely and prototype often

- Pick carefully and develop only one product

- Do NOT launch for growth until you have a sure hit

10. Learn to Love Process Control

Process control is the dividing line between hype and execution. If you want to sleep soundly at night, you need process control.

As a corollary:

- Don’t tune out your skeptics and pessimists.

- Optimists enjoy starting new things; pessimists want to finish and survive.

- Keep the pessimist close by, if you want to arrive at your destination.

And, lastly:

Before you assess a novel technology, assess yourself.

Do you have the temperament? Are you personally inspired by the invention?

Although you face technical risk, you can manage that with discipline and planning.

Although the path is longer, it is also more leveraged.

Commercializing a deep-tech innovation can meaningfully improve life for others, and that provides a profound feeling of satisfaction for the rest of your life.