We launched Pillar in May 2016 with a focus on trying to align our interests as investors with the founders and teams we were backing. An important element of this effort was offering to buy Common Stock in companies.

We launched Pillar in May 2016 with a focus on trying to align our interests as investors with the founders and teams we were backing. An important element of this effort was offering to buy Common Stock in companies.

Why? Because we felt that the standard 10-page venture capital term sheet was riddled with terms and conditions that could cause misalignment among the parties, impacting trust and potentially compromising the performance of the investment.

It isn’t that we thought the standard deal was inherently bad, we just didn’t like the dynamic it created. It wasn’t for us.

Instead, we proposed a far simpler structure where we own the same security as the founders — Common Stock — aligning interests, increasing trust and hopefully, enhancing the performance of the investment. We were in it together with a common goal.

The math also told us we weren’t giving up much. In 18 years of investing, it was rarely the case that the structure of an early stage investment impacted the returns to investors — and in the rare case it did, the dollars and cents were very small.

We concluded that we weren’t going to build the next Sequoia or Greylock on downside protection, our best shot was to fully align ourselves with great entrepreneurs to try to build world-changing companies. In essence, we traded a small amount of downside protection for what we hoped was a large amount of upside enhancement.

We wrote about it here and here.

Now, nearly 3 years since we started, and as we near the end of the investment period for our first fund, it’s a good time to reflect on what we’ve seen and how we’ve adapted our approach.

I’ll preface by saying we knew this was a Movement that was going to take time — no single firm was going to change a $100B industry, not overnight — but we are pleased with the progress and the growing momentum we see towards “aligned” investing.

The Takeaway: Founders universally applaud the initiative. We’ve made many Common Stock investments and top-tier VC firms have joined us in those investments — also buying Common Stock. As much as we’d love to share the names of these VCs or the companies they backed, we don’t think it's our place to call them out here.

Pillar's Investments in Fund 1

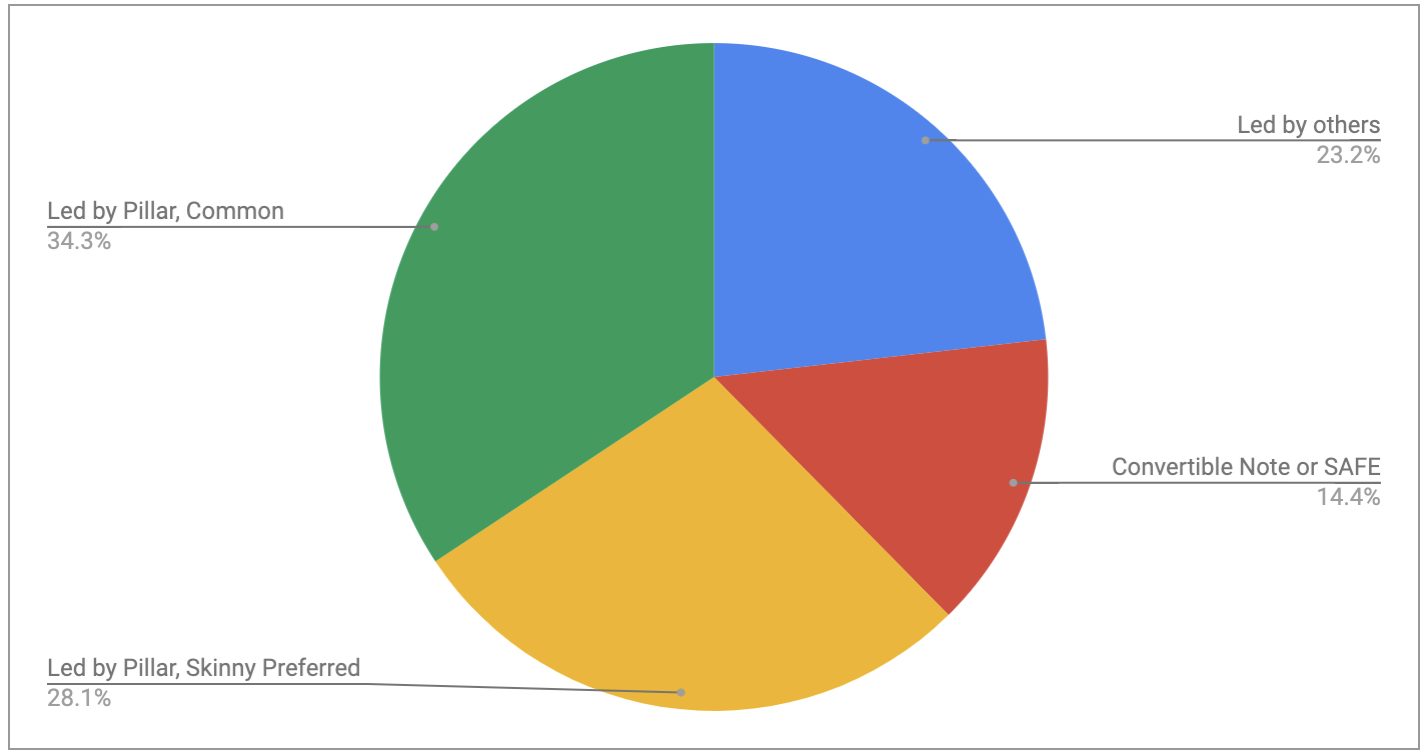

Overall 34% of our seed and pre-seed capital went into initial rounds structured as Common.

28% of our investments were “Skinny Preferred” where Pillar led but where founders, given the option, chose to include a Preference but eliminated clauses such as anti-dilution and dividends.

14% of our capital went into Convertible Notes or SAFEs that converted (or will) into rounds led later by VCs with standard Preferred terms.

23% of our capital went into Rounds that were led by other VCs using standard Preferred terms.

Sometimes Founders Chose to Include a Preference

For rounds Pillar led, half of our capital (55%) was invested in Common but that means that nearly half (45%) was not. Why would a Founder choose a less attractive structure? We believe two main reasons:

a) Founders feared that other VCs would be resistant to joining the syndicate if it meant they’d have to invest in non-standard terms. This was a battle the Founders didn’t want to take on.

b) Founders were told that selling common would screw up their option pricing. I’ll discuss option pricing for Common deals in another post. The short answer — for pre-revenue companies, is that it is not an issue. Curious? Here is an overview of the Asset-based approach to 409A.

What about Follow on Rounds?

While our expectation was that none of our companies would raise follow-on rounds that were also Common, we have seen Common Stock Series A rounds. Just one so far and a unique situation at that. So, it can happen but we continue to believe this will be a rare, albeit welcome, occurrence.

Innovation Bubbling?

We are delighted to hear of other firms innovating around Common-style deals — the most recent iteration being an offer to buy Common Stock in exchange for a super pro-rata right in future rounds. This structure recognizes that the VC business is driven by big outcomes. If you think you are in one of those winners, you want to own as much as you can (buying more than your pro-rata in the next round, aka “super pro-rata”). If you aren’t in a winner, whether you own Common or Preferred is not going to move the needle.

Summary

When we announced our plans to buy Common Stock, most investors agreed with our logic but thought we were crazy to buck the system. Meanwhile, entrepreneurs applauded. They appreciated what we were doing. Trying to change the world, just like they were.

The jury is still very much out, but we are pleased that 1/3rd of our early-stage capital has gone into Common investments and that over 1/2 of that capital has gone into more aligned structures (Common or Skinny Preferred). Other VCs have joined investments in these structures and we are now beginning to hear of other firms experimenting with similar concepts.

A movement has begun…we just need to keep pressing forward, patiently.

Our standard term sheet is copied below.

As always, questions and comments welcome.

Jamie Goldstein

Jamie Goldstein